Brad Templeton Home

Robocars

Main Page

Brad Ideas

(My Blog)

Robocar Blog

My Forbes Articles

(Book from 2008)

The Case

Sidebars: Charging

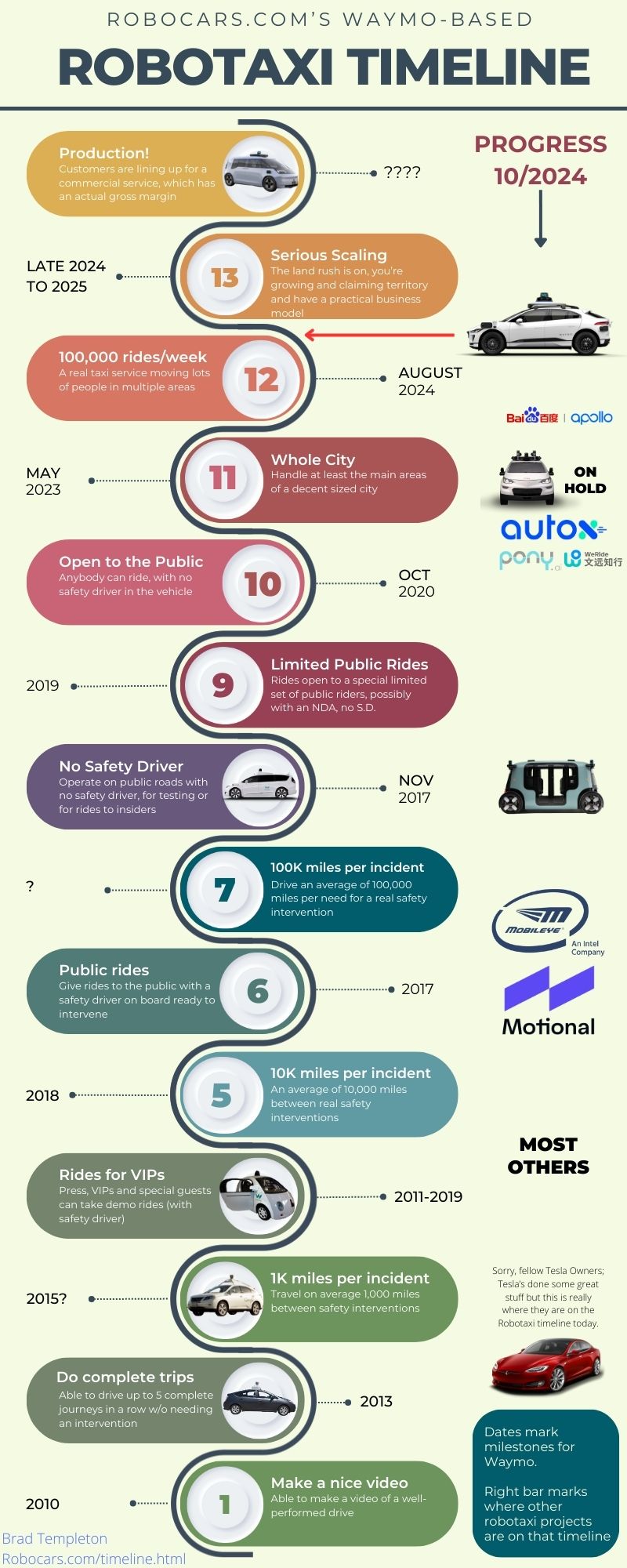

Robotaxi Timeline

The Robotaxi timeline is based on publicly visible milestones for a robotaxi service. The main timeline comes from dates for Waymo, which is the leading service (and where I worked many years ago.)

(There is also a Forbes.com Story on the Timeline

On the right are estimates of where other teams are along this path of progress. Waymo isn't all the way to the end, and the others are behind it.

Most companies keep their real data confidential. As such we can only judge them on what they do and what they have the courage to do. If a company is willing to go out without a safety driver, it means their internal numbers said that was safe enough to do. If they let passengers in, that's another big statement. If random members of the public can come in and make videos and publish them, that's an even bigger statement of confidence and tells us what their internal numbers tell them.

Not all teams will necessarily do things in the same order, or do all the steps. It is particularly hard to measure the progress of Chinese teams, as news in China works differently. So while I rank Baidu Apollo ahead, as they have the largest fleet and report doing over 70,000 rides/week, I do not have accurate information on their safety numbers. As such, you can consider AutoX, Pony.AI and WeRide to be in roughly similar positions.

Cruise was in the middle of big expansion when they put everything on hold. They are not dead yet so they retain that position, though in time they will fall.

Zoox has done some operation with no safety driver, and states they will do ride service in Las Vegas with no safety driver this year.

Motional and many other teams have done limited ride service, and always with a safety driver. In many cities in China, operations have a safety driver.

MobilEye did a test robotaxi service but stopped it, so their progress is hard to measure. They will licence to other companies to build robotaxis, including Verne and some Chinese players so far, but probably many more.

Nuro, until September 2024, was not working on robotaxi and was building medium sized delivery robots. As such they have run at low speed with no safety driver, but never carried passengers. Now, they do plan to make the systems for another company to build a robotaxi on top of it.

Companies like Aurora are not currently deploying or testing their robotaxis. Companies like Wayve, Waabi and others have not yet done more than video demos and not published numbers.

Tesla's position is particularly challenging. Telsa currently only has a driver-assist system which requires constant supervision. They state they plan a robotaxi product, based on this technology, "next year." The current SFSD system is at the level of being able to do a few complete trips in a row, about where Waymo was in 2014-2015, but not able to drive 1,000 miles without multiple safety incidents. Tesla does this with less use of maps, and can do driver assist on most U.S. streets. The robotaxi companies also could drive without maps (they need to in order to handle construction zones) but currently operate their systems only in defined service areas. Should Tesla release a robotaxi service, it also will have defined service areas.

Tesla would get big points for its transparency -- more people have had a chance to try it out -- bad sadly that transparency reveals a poor quality system.

Ford and Apple had robotaxi projects, but cancelled them. Several other startups also have died or pivoted.

Covid

Was Waymo slowed a lot by Covid? Possibly, but not a lot and perhaps not at all. Covid created great demand for a ride without a driver, though that was not available to the public during the core of the pandemic. But Uber still did very well (though partly due to food delivery.) If Waymo had full public rides in vacant vehicles before Covid, they would have soared, but at that stage they were not ready to scale.

Rankings and Tesla

Because Tesla is currently 8 years behind Waymo on the timeline, it does not necessarily mean they will take 8 years to get ready to scale. They may be able to do things faster than Waymo, they may also be slower. Their current planned approach of pure machine learning with only cameras may be easier to make work, it may not ever be able to work at all with current hardware or even the next generation. Their lack of LIDAR and radar may block them, or they may get past it. It is reported they will re-introduce more sophisticated radar. Tesla may also change its approaches or adopt new technology; they have already done major restructuring of their entire system at least twice, as have other teams.

Tesla can move faster than Waymo because they can use AI technology that didn't exist when Waymo was building their system. (Indeed, the core transformer technology was invented at Google.)

In some cases though, time is needed not simply to make self-driving reach desired safety levels, but for all the other things that go into a robotaxi, including logistics, infrastructure, apps, fleet management and much more. The long tail of road behaviour is very, very long and takes time to learn and to do testing and verification to assure it can be handled. This is what has taken up most of Waymo's time in the 6 years since they first put a vehicle on the road with no human being aboard.

All teams of course get to take advantage of advances in processor technology and AI tools at roughly the same time, which can be an advantage to the second movers.